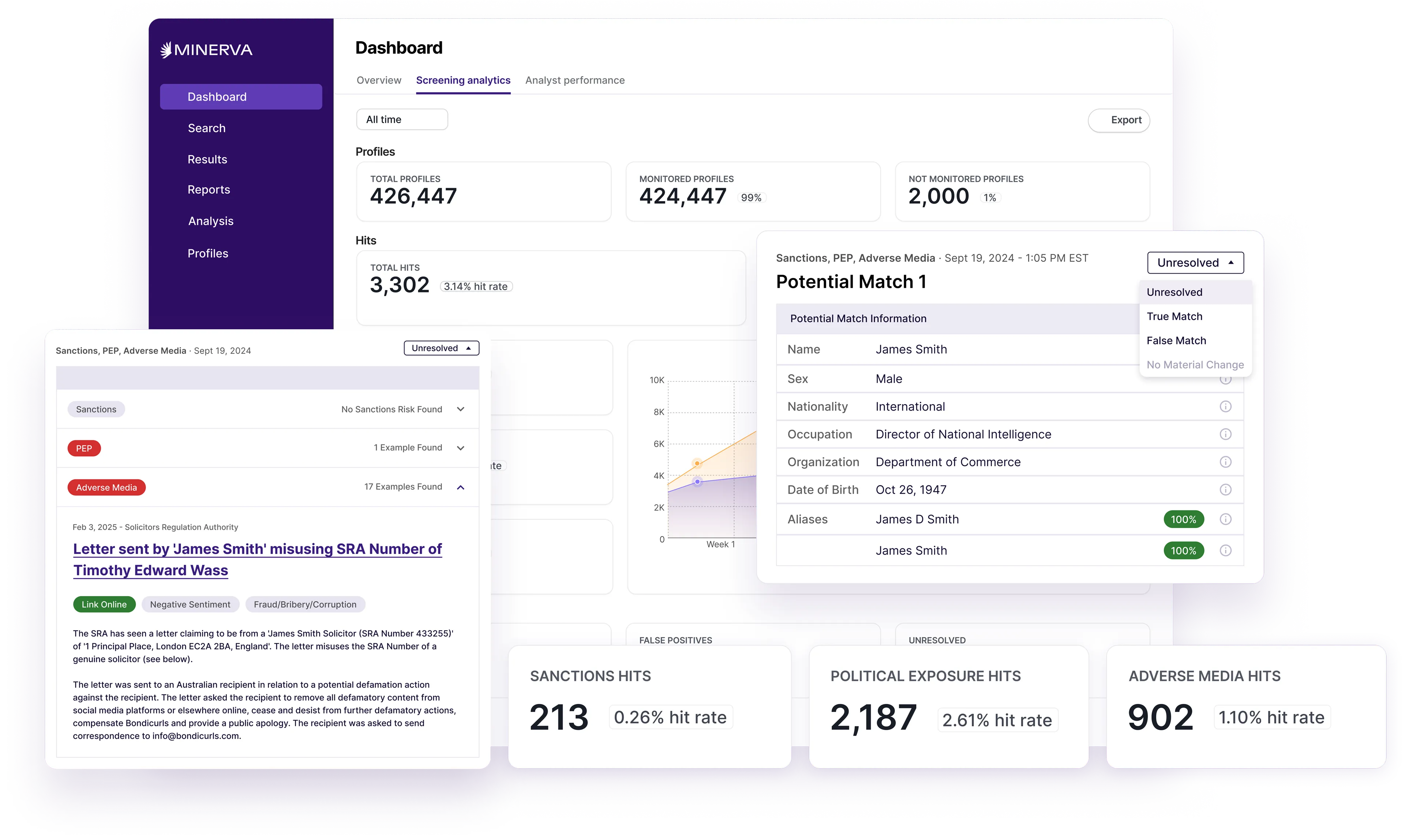

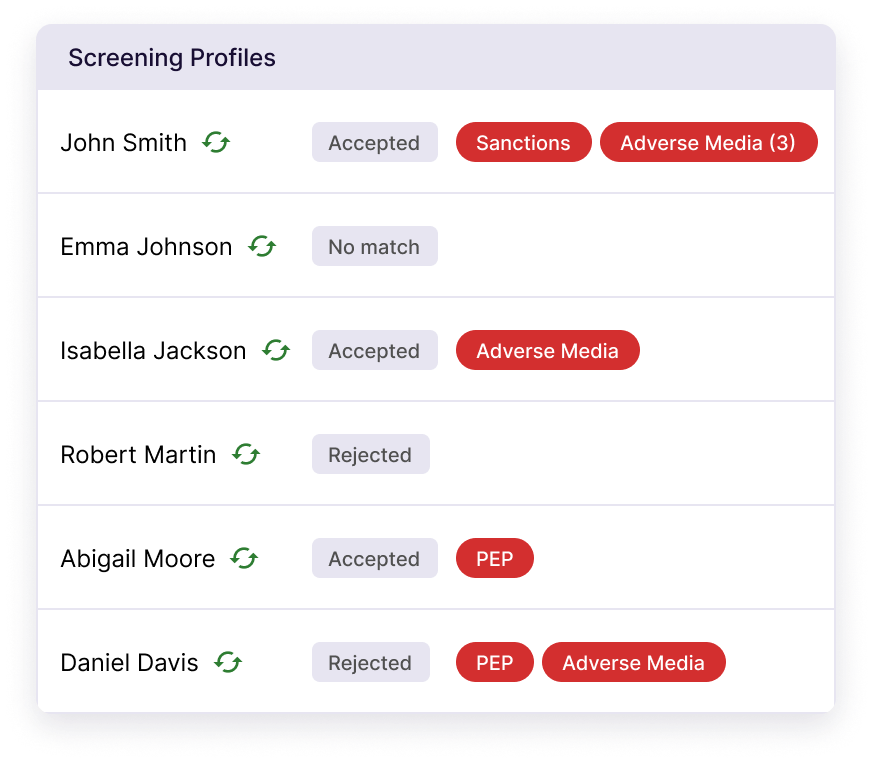

AML Name Screening and Ongoing Monitoring That Scales

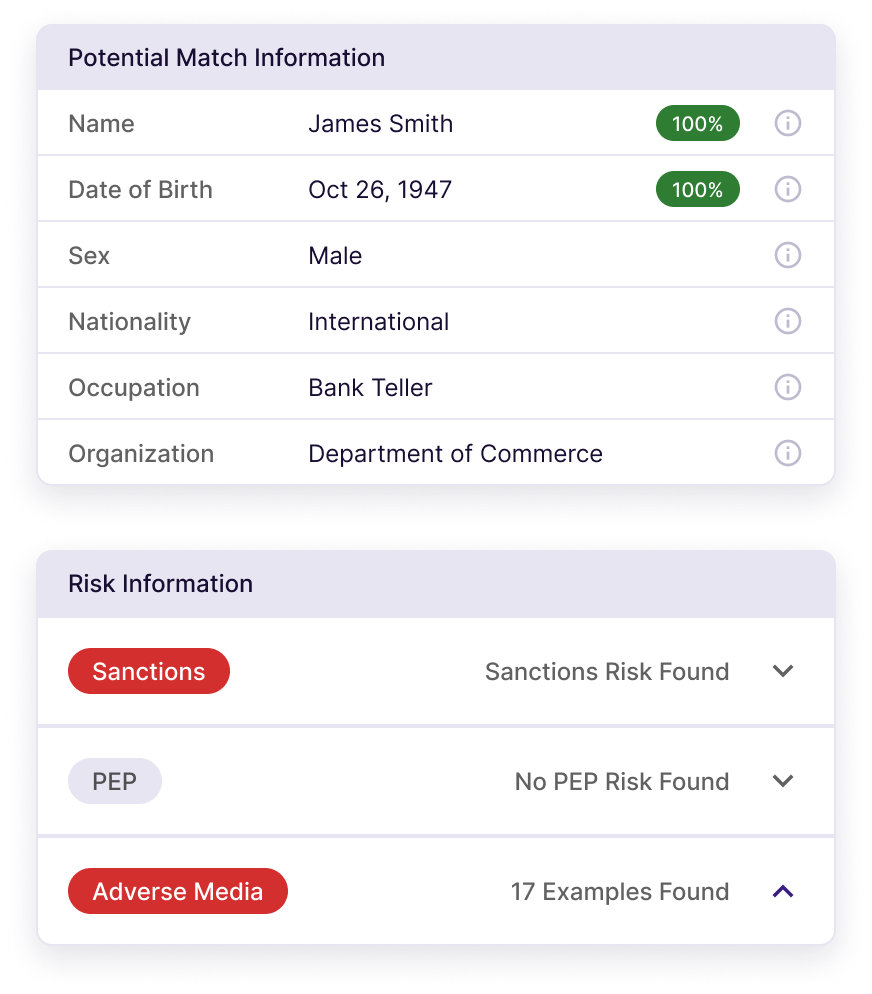

Minerva's AI-powered risk screening across Sanctions, PEPs, and Adverse Media delivers 75% fewer false positives, letting compliance teams zero in on actual risks that matter.

Leading Compliance teams Rely on Minerva

The Problem

Legacy AML screening workflows are broken

Compliance teams waste more than 50% of their time on false positives. Legacy systems create unmanageable backlogs, hours of manual research, and make it difficult to understand how your compliance program is operating.

The Solution

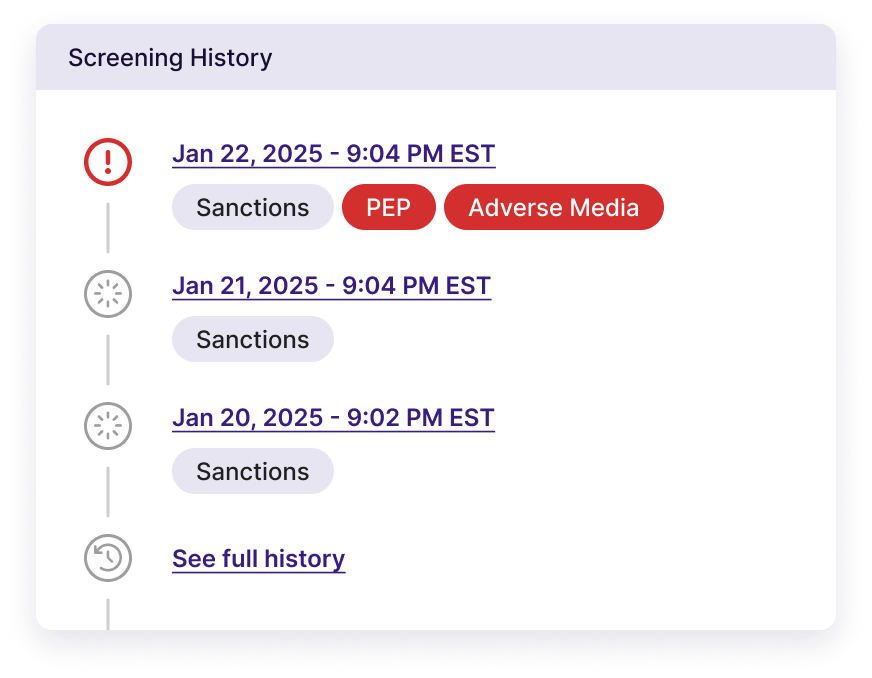

Minerva makes AML screening seamless

Designed by AML industry experts, Minerva uses AI to surface fewer false positives. With a simple screening workflow that includes ongoing monitoring and reporting, it's easy to keep up with your growing company.

Trusted by top compliance leaders

Built and tested for scale

Why compliance teams trust Minerva

Fewer alerts, without missing true risk

Minerva’s screening engine is best-in-class and reduces false positives by 75% so your team to focus on true risks.

Ease of integration and migration

Minerva makes integration effortless. With a simple setup and seamless API integration, you can get up and running in no time.

Built and supported by AML experts

Our founders are AML experts dedicated to helping you strengthen your compliance program and maximize the value of Minerva.

Detect risks, not noise

Cut false positives by 75% and streamline reporting with Minerva, so you can focus on what really matters, identifying true risks.