Time is money. Save both with real-time AML.

Minerva is a risk assessment platform purpose built for anti-money laundering at scale.

Unlock faster investigations, fewer false positives, and a compliance program at half the cost.

Trusted by Leading financial institutions and innovators

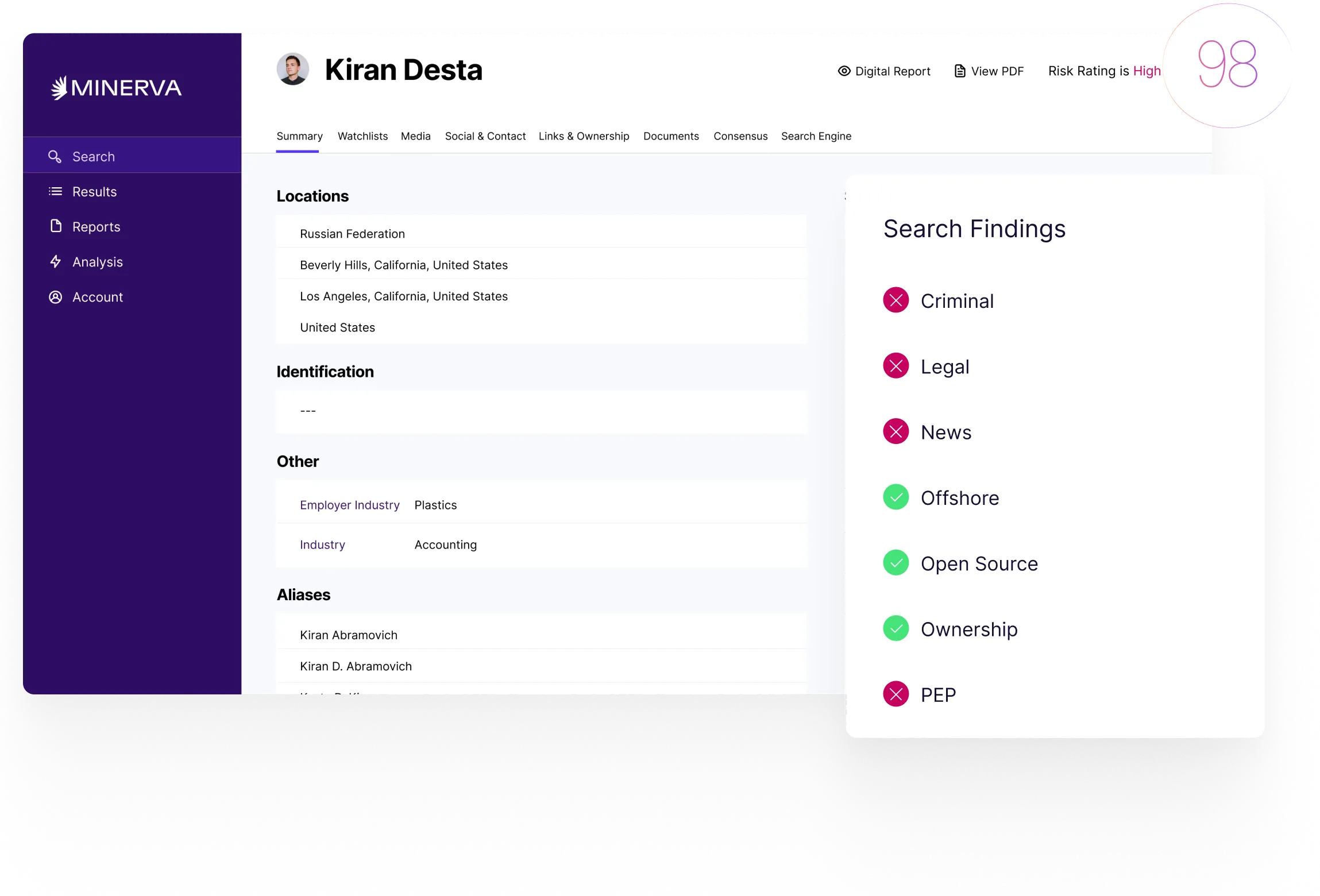

Your comprehensive investigation platform

Context is everything. Understand it in seconds.

When it comes to risk decisions, context makes all the difference. Minerva uses deep learning to understand the details of each customer and the broader context they operate in—delivering actionable insights in seconds with 15% fewer false positives than the competition.

- IDV, KYC, & KYB

- Beneficial Ownership

- Sanctions, PEP & watchlists

- Investigations & EDD

- Adverse & Social Media

- Ongoing Monitoring

CONFIGURABLE RISK RATING

Get risk ratings for your unique risk tolerance

Every organization has a different risk appetite. Minerva has a highly configurable model based on FATF guidance and industry best practices, so your risk ratings consistently reflect your unique risk tolerance.

HOLISTIC RISK

See the full picture, fast

Know your customer, and everyone they know, too. Minerva helps you identify relevant networks and relationships quickly, easily and visually, so you can explore connections in depth and get to the root of risk with a faster, more efficient investigation.

DATA LINEAGE

Regulator-ready reporting in one click

Minerva produces a complete audit trail in a regulator-ready report automatically. So your investigators can focus their time on analysis instead of tedious document collection and compliance.

Here’s how it works

Powered by deep learning

Minerva accesses billions of accurate and verified data points in real time, every time.

Profound entity resolution

Minerva reduces false positives by creating data-rich profiles that differentiate between subjects.

Contextual awareness

Minerva understands context, sentiment, and financial crime risk, providing relevant and immediate analysis.

Trusted by top compliance leaders

AML solutions for every industry

All-In-One, AI-Enhanced Risk Screening

We put the world’s data to work on a comprehensive compliance platform.

Discover more efficient, effective investigations.