GeoComply and Minerva propose “made in Canada” solution to tackle fraud and money laundering

[Vancouver/ Toronto, Canada – September 4, 2024] – On the heels of substantial fines being levied against one of Canada’s leading financial institutions for anti-money laundering (AML) non-compliance, two Canadian technology leaders, GeoComply and Minerva, announce a timely partnership to fight financial crime and money laundering in Canada. This collaboration, led by two of Canada’s prominent female entrepreneurs in banking and cybersecurity, Anna Sainsbury of GeoComply and Jennifer Arnold of Minerva, represents a significant step forward in anti-money laundering (AML) efforts in Canada.

The recent banking fines highlight the urgent need to enhance AML and fraud prevention measures within the financial sector. GeoComply and Minerva, industry leaders in fraud prevention and AML compliance, will combine their decades of experience and cutting-edge technologies to empower financial institutions with proactive risk management tools.

“This partnership is a testament to our commitment to combating financial crime and protecting the integrity of Canada’s financial system,” said Anna Sainsbury, co-founder and CEO of Vancouver-based GeoComply. “The integration of these technologies will empower the banking sector to identify and block bad actors more effectively, use AI and location data as unique identifiers, and track bad actors in real time. By combining our technologies, GeoComply and Minerva can bridge a gap in the market, offering precise, actionable data that is proven to offer protection while not overburdening the entities that use it.”

GeoComply’s geolocation technology verifies a user’s location instantaneously during transactions to ensure compliance and helps gaming operators track and analyze suspicious activities in real time. By rooting online transactions in physical locations, the data can also support investigations by law enforcement, making it possible to identify a suspected criminal’s physical location.

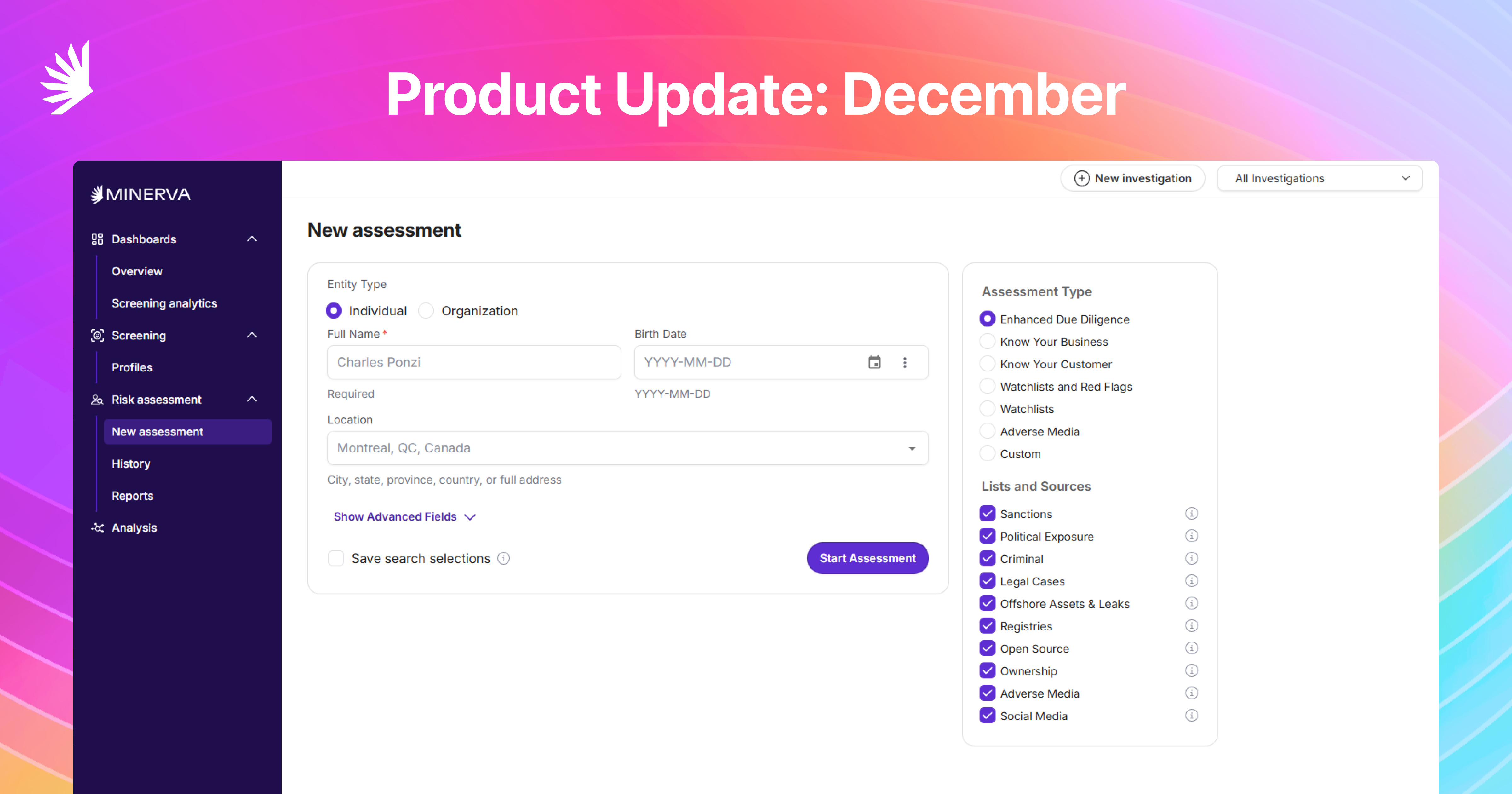

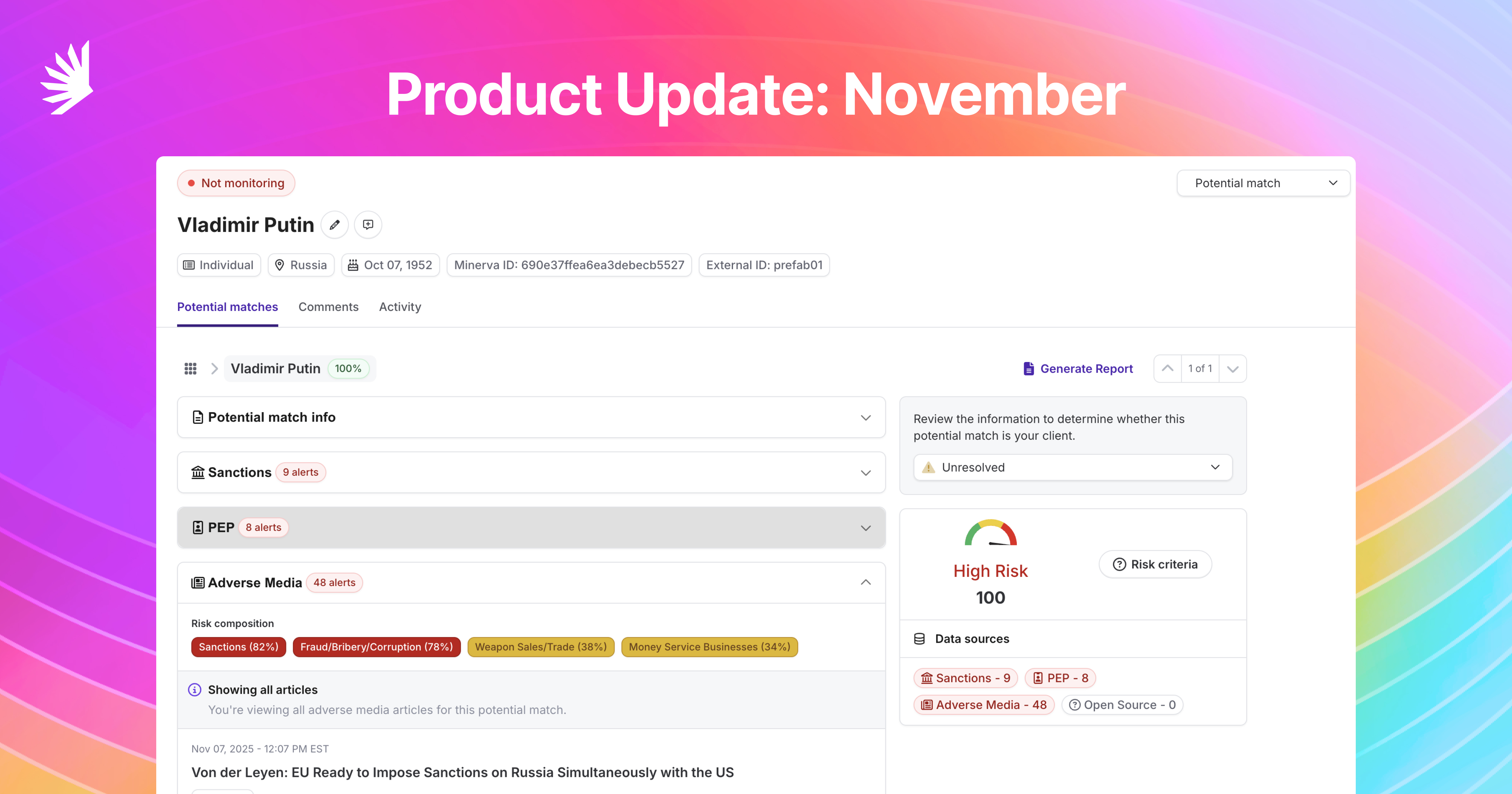

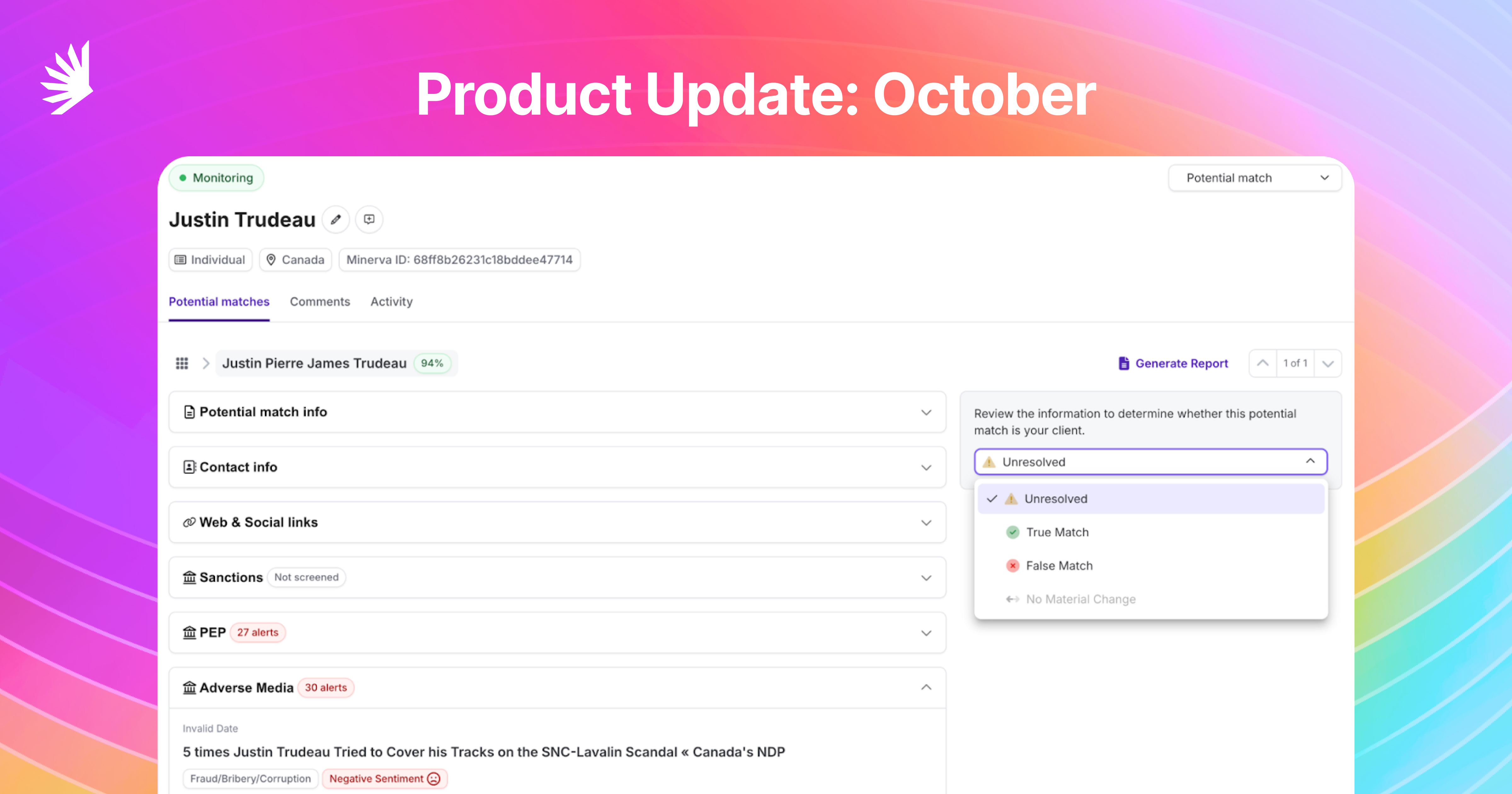

Minerva’s risk assessment platform consumes accurate, current and relevant data and analyzes it for financial crime risk in real time, then provides the ability to share that information in real time.

“GeoComply’s geolocation data is the perfect complement to our real-time anti-money laundering risk assessment capabilities,” said Jennifer Arnold, founder and CEO of Toronto-based Minerva. “Together, we can empower customers to avoid onboarding a bad actor in the first place, and provide a robust shield against bad actors so they can proactively identify and mitigate risks, ensuring a safer and more secure environment for all Canadians.”

Between $45 billion and $113 billion is laundered annually in Canada, according to the Criminal Intelligence Service Canada. The 2022 Cullen Commission report highlights the need for technological advancements in AML detection and reporting. The illicit activity has been blamed for driving up home prices and is so prolific in Canada that it has been dubbed the “Vancouver Model” or “Snowwashing.” The Cullen Commission recommended that the federal government propose a new Canadian Financial Crimes Agency and consult on new regulations to tighten up the financial system.

In the meantime, FINTRAC, the federal agency responsible for monitoring suspicious activity in Canada, “issued 12 Notices of Violation of non-compliance” to financial institutions totalling more than $26 million since the beginning of 2023 alone.

A safer, more secure financial future

The focus on reporting errors rather than criminal activity itself underscores the opportunity for better risk management. The Cullen Commission emphasized technology’s critical role in this, urging the sector to use it for enhanced detection, reporting, and combating money laundering.

However, the challenge lies in deploying technology that’s both effective for law enforcement and less burdensome for banks. The stark disparity between the 31 million suspicious activity reports filed in 2019-20, and the mere 393 police investigations supported reveals a clear gap in the utility of data submitted to FINTRAC.

Their shared commitment to innovation and security is driving this powerful alliance set to revolutionize the security landscape for gaming companies, fintechs, e-commerce platforms, and the crypto industry. Leveraging their experience in highly regulated markets, will undoubtedly bring forward new innovations that will enhance the financial sector’s ability to tackle money laundering.

About GeoComply:

GeoComply provides fraud prevention and cybersecurity solutions that detect location fraud and help verify a user’s true digital identity. Trusted by leading brands and regulators for the past 10 years, the company’s geolocation solutions are installed on over 200 million devices and analyze over a billion transactions every month.

GeoComply’s award-winning products are based on the technologies developed for the highly regulated and complex US online gaming and sports betting market. Beyond iGaming, GeoComply provides geolocation fraud detection solutions for streaming video broadcasters and the online banking, payments and cryptocurrency industries, building an impressive list of customers, including Akamai, Nextdoor, BBC, BetMGM, DraftKings, FanDuel, and Luno.

About Minerva:

Minerva is a RegTech leader founded by Anti-Money Laundering (AML) industry experts to transform AML compliance. The company’s proactive AML platform uses sophisticated deep learning models and neural networks to analyze billions of data points in 147 languages to help compliance teams get ahead of financial crime. With its ability to instantly understand context, sentiment, and risk across structured, unstructured, open source, and proprietary data, the Minerva platform creates context-rich customer profiles and predictive risk analysis in real time. Minerva is trusted by leading financial institutions that require faster, more accurate risk assessment results.

Download the guide

Download this Resource

Stay a step ahead with insights and updates from Minerva

Explore more

All-In-One, AI-Enhanced Risk Screening

We put the world’s data to work on a comprehensive compliance platform.

Discover more efficient, effective investigations.