Guide to Beneficial Ownership: How to strengthen your AML program

From Panama to Pandora Papers, Shadow Diplomats to Russian oligarchs, the global financial system continues to be rocked by scandal. At the heart of these abuses are anonymous corporate structures and other opaque financial vehicles that shield the real culprits from exposure and prosecution, devastating the countries and people they steal from.

Why do these loopholes exist? What’s happening to address accountability and transparency? And will proposed solutions like ownership registries even work?

Progress is being made. Almost all of the Financial Action Task Force (FATF) member countries have enacted legislation to tighten beneficial ownership information collection, and to implement mandatory ownership registries that drill down beyond legal ownership to the “natural person(s)” who are truly benefiting. While commitment is strong, progress is slow, and in the case of recent European Union privacy ruling, progress on registries has stalled.

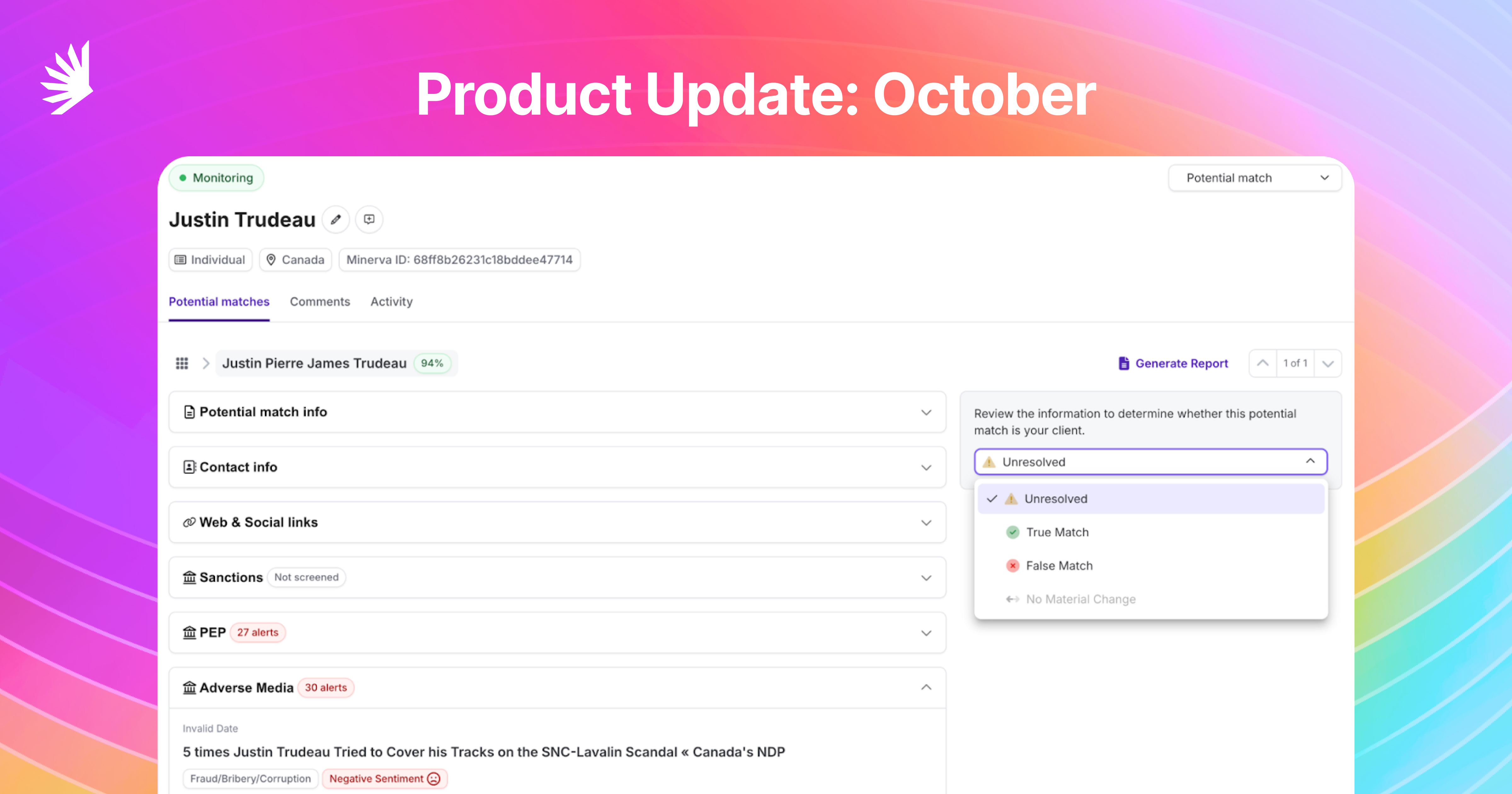

Financial Institutions (FI’s) and financial services businesses like brokers, payments facilitators and crypto exchanges, remain on the front lines, bearing the burden of beneficial ownership identification – without the assistance of consistent, governed, and reliable data. Procedures to gather and verify ownership are highly manual, error-prone and expensive; and not thorough enough to obtain a full view of entity structure or risk. Regulations are often unclear or lack specificity on how to address key risks like sanctions, politically exposed persons (PEPs) and adverse media related to controllers or owners.

Our guide outlines mandatory requirements for doing business in Canada, the United States, the United Kingdom, the European Union, Australia and Singapore; the progress of their registries, along with key challenges and how you can strengthen your beneficial ownership program through the use of open source data and artificial intelligence to make your AML compliance processes work better and cost less.

Download the guide

Download this Resource

Stay a step ahead with insights and updates from Minerva

Explore more

All-In-One, AI-Enhanced Risk Screening

We put the world’s data to work on a comprehensive compliance platform.

Discover more efficient, effective investigations.